|

||||||

|

||||||

The challenge

|

||||||

|

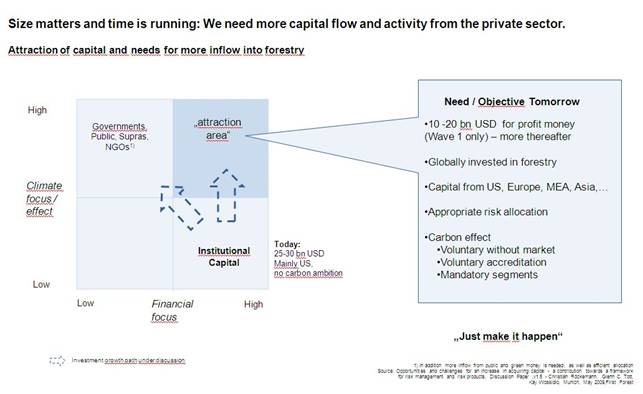

However, we face a gap. The current setup does

not generate the momentum needed. In global climate related initiatives

forestry often is only one of many, and so far the financial relevance is

only minor. Based on a multi-stakeholder-approach and low financial market

participation in forestry aspects, it lacks a systematic link |

||||||

|

What is most critical for forestry and its carbon component today is that professional foresters, investors, and risk managers create an integrated quantitative framework generating risk, financial and carbon estimates. The private capital and financial markets needs quantitative measures and/or estimates to enter the market in larger scale. It needs to be shown, that forestry can be “operated” in a way that suits private capital market standards. We need pilots and then a broader use of risk management and transfer in the forestry market to establish a common ground and language to clearly communicate in terms of expected, estimated and realized risk, financial performance and carbon profile. However, from our experience this will not develop organically. It needs facilitation. |

||||||

|

|

||||||

The initiative

|

||||||

|

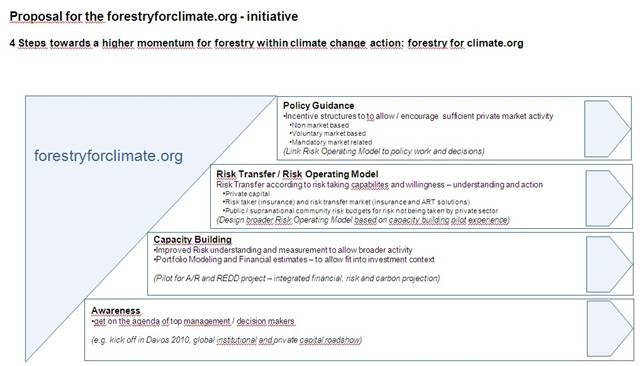

The forestryforclimate.org Initiative is designed to fill the gap described. We propose a market driven “hands on” 4-step approach to make forestry for climate happen. While the four steps build on each other, they should also be complimentary and interdependent. run in parallel. Awareness is needed by top management of large and influential corporations, including large institutional investors who can quickly make a difference. Capacity building is needed, especially with financial and risk management institutions to leverage the potential of the investment, capital and risk markets. There seems to be the methodology to generate integrated performance, risk and carbon estimates for forestry. Pilots for both A/R and REDD projects can lead the way and build the basis for the next step. Quantitative portfolio modeling, financial and carbon estimates will be a “translator” between foresters, forest managers, forestry research and climate change experts working with risk managers, investors and other private capital. It may provide policy makers the “data” needed for decisions and the appropriate guidance and cost/benefit for resource allocation. The understanding of investment and risk appetite of private capital and the public call for action need to connect via “risk transfer” mechanisms and what we call the risk operating model: what are the key risks to be managed, what is the financial and carbon relevance, how can they be managed on a portfolio level and who is willing to bear them – investors, risk managers or public institutions? The policy guidance is a condition sine qua non, to ensure the size and speed needed. This includes appropriate incentives in any segment of action, be it non market based, voluntary market based or in mandatory markets. |

||||||

|

|

||||||

What we need? |

||||||

|

We encourage you to join this proposed initiative in one of the needed roles -

Co-initiators -

Funding sponsors -

Working team members and -

Others who want to help to

make the initiative a success. This includes corporate and institutional investors, industry, private individuals, risk experts, supra-national organizations as well as think tanks, research organizations, and private and public foundations. |

||||||

|

|

||||||

|

For

further information and support please contact |

||||||

|

|

||||||

|

Judith Alt |

||||||

|

forestryforclimate.org |

||||||

|

c/o First Forest GmbH |

||||||

|

Telefon +49 (89) 3270 897 – 0 |

||||||

|

|

||||||

|

|

||||||

|

|

||||||

|

Impressum: |

||||||

|

|

||||||

|

forestryforclimate.org

– An initiative proposed by |

||||||

|

First Forest GmbH |

||||||

|

Geschäftsführer: Dr. Christian Röckemann |

||||||

|

|

||||||

|

|

||||||

|

Legal Information: |

||||||

|

The

contents of this internet site is protected by various national and

international copyright laws, trademark, and servicemark laws. |

||||||

|

You

may not copy, reproduce, republish, upload, post, transmit, or distribute in

any way material from First Forest without permission. Doing so is a

violation of First Forest's copyrights and other proprietary rights. Some

images or materials may be protected by trademarks, servicemarks, or

copyrights of other persons or companies. |

||||||

|

Nothing

on the First Forest Website should be construed as a solicitation or offer,

or recommendation, to acquire or dispose of any investment or to engage in

any other transaction. |

||||||

|

The

information contained herein does not constitute investment advice. First Forest

reserves the right to change, modify, add, or remove portions of these terms

at any time. |

||||||

|

While

First Forest uses reasonable efforts to obtain information from sources which

it believes to be reliable, First Forest makes no representation that the

information or opinions contained on the First Forest Website is accurate,

reliable or complete. The information and opinions contained in the First

Forest Website are provided by First Forest for personal use and

informational purposes only and are subject to change without notice. Nothing

contained on the First Forest Website constitutes investment, legal, tax or

other advice nor is to be relied on in making an investment or other

decision. You should obtain relevant and specific professional advice before

making any investment decision. |

||||||

|

First

Forest is in no way responsible for the content of any site owned by a third

party that may be linked to its internet sites by hyperlink, whether such

hyperlink is provided by First Forest or by a third party. Users and sites

may include a link to First Forest internet site only by pointing to its

homepage (www.firsforest.com) and only if any discussion of First Forest is

truthful and not misleading. First Forest makes no representations whatsoever

about any other internet site which you may access through this one. When you

access a non-First Forest internet site, please understand that it is

independent, and that First Forest has no control over the content on that

internet site. In addition, a link to a non-First Forest internet site does

not imply that First Forest endorses or otherwise accepts any responsibility

for the content, or the use, of the linked internet site. |

||||||

|

The

First Forest Website is not directed to any person in any jurisdiction where

(by reason of that person's nationality, residence or otherwise) the

publication or availability of the First Forest Website is prohibited.

Persons in respect of whom such prohibitions apply must not access the First

Forest Website. In Germany the Website especially is not targeted to private

individuals. The investments discussed on this Website are especially not

intended for distribution into the United States of America, Canada, Great

Britain and Japan and not authorized in any way. |